Translate

Totally FREE and Great Deals

Tuesday, December 28, 2021

How My Family Earn Money from Our Money Monthly

Tuesday, December 7, 2021

Cutting the Cord- Best Cable Alternatives

Cut the Cord-Check this Best Cable Alternatives

Came across this amazing site. I am pretty sure we all wanted to save money on TV Cables as well as digital video streaming subscriptions. My self included. Trust me, I am always for the lookout for free trials, discounted subscription and most especially FREE deals.

Please do check out the Killthecablebill.com . Just click here.

Their site includes:

- Top streaming services and deals -- plus: how to get local TV free via old-school antennas

- How to get free trials for Disney+, Hulu, Amazon Prime video, and more - enough to keep you watching for months

- How to avoid streaming scam sites

It feels so great enjoying video streaming when you know you are not overpaying your cable TV service provider. Happy streaming everyone!

Thursday, November 25, 2021

Enter For A Chance To Win Six Bestselling Book Club Reads.

Enter For A Chance To Win Six Bestselling Book Club Reads.

Enter this Book Sweepstake for a chance to win these bestselling books from the GCP Club Car. Enter here .

Win a Library of Books from the Pantheon Graphic Library

Win a Library of Books from the Pantheon Graphic Library

If you are a fan of graphic novels enter now to win these Graphic Books from Pantheon Graphic Library. Three lucky winner will win ten titles from legendary authors. Enter now. Just click here .

Zippo Holiday Sweepstakes

Enter https://www.zippo.com/pages/zippo-holiday-sweepstakes

Three lucky winners will score a holiday gift pack. Click here for a chance to win! Good luck!

Sunday, November 21, 2021

How I Plan My Family's Monthly Finances

I've been doing monthly financial plan since I got married. This has made my/our lives so much easier and less stressful when it comes to my family finances.

Growing up, I was not taught to budget or be mindful of my finances. I learned a little here and there when I was in college. As my allowance was not that big, I had to budget or my money won't last until the next money transfer from my parents.

My Monthly Financial Plan is simple and designed according to my family's lifestyle. I did not want to complicate my life with so many categories. I also incorporated on my budget plan based on what I learned from reading financial books, following financial influencer on Youtube and blogs.

I hope you'll get some ideas from this blog and also if you have not started on monthly budgets, may by this blog you'll be able to start your own Monthly Financial Plan.

I would like to introduce my Monthly Financial Plan by categories.

1. Income and Savings

When it comes to savings and investment, I like to set it up auto transfer from my bank to that high yield savings account or an investment account.

2. Bills

Again, I would like to set up all of my bills to autopay. This way, I am sure that nothing is going to be late when it comes to paying on time. There's also some who give discounts when you set up payment to autopay like T-Mobile.

3. Clothing Expense Tracker

First and foremost, when it comes to clothing my family does not buy clothing/shoes/RTW items monthly. Usually, we only buy ready to wear items when there's a birthday and on Christmas. What I am showing here is only an example. I also buy some clothing, shoes, or jackets for my daughter during School Opening and or change of season.

4. Grocery Expense Tracker

I have a certain amount that I allocate for our grocery every month. I tried my best to spend less than what is allocated monthly. The allocated amount is already based on our monthly grocery expenses per month which I calculated from previous months, and I added a bit more, just in case I get over what is our usual grocery expenses. If our monthly grocery expenses is less than what is allocated, I get to save the difference.

I would like to explain what is "Points Applied" column. The points applied column is/are the points I got from this grocery shopping. Like if I used a bank card that has points in them like cash backs for a corresponding dollar amount I purchased such as: using a credit card with % rewards.

Or by scanning receipts to Ibotta which give cash backs for certain eligible items that you bought. If you are interested in this, you can sign up here: https://ibotta.onelink.me/iUfE/8cc13c64?friend_code=agp6w

Or scanning receipts to Swagbucks and earn points to be redeemed into so many ways including Paypal. If you are interested you can sign up here: https://www.swagbucks.com/lp-savings-button?cmp=695&cxid=swagbuttonref&rb=4282463&extRefCmp=1&extRb=4282463

Or scanning receipts to Fetch Rewards that you can convert points into so many different store gift cards. Including Amazon gift cards. You can sign up here: https://fetchrewards.onelink.me/vvv3/referraltext?code=6F2JM

5. Family Expenses Tracker

My husband and I have an agreement that whoever is gifting somebody, that person's saving account is the source of that family expenses. This style works for us. We do send a certain amount on each other's savings account per pay check/monthly via auto transfer.

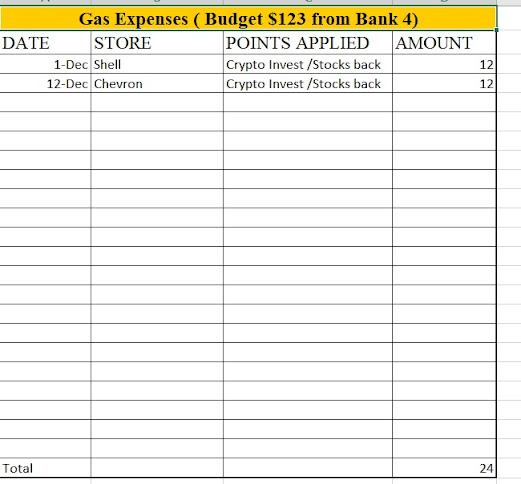

6. Gas Expenses

Our gas monthly budget is sent to a checking account offered by a stock brokerage monthly. This stock brokerage offers a certain percentage 3-4% on every purchase and convert to stocks that would be automatically added to your personal investment portfolio. This is like a credit card cash back but instead of using a credit card, we're using a checking/debit card with stocks back for every purchase.

Actually, this is the same as our grocery monthly budget. On our grocery monthly budget we use another checking/debit card on another Stocks brokerage with stocks back for every purchase.

7. Eating Out/Entertainment

My family likes to relax, spend quality time, talking about anything and laughing on any funny stories together while eating out. So, I allocate a monthly budget for our family for eating out. This also includes, watching movies on theaters, and any kind of entertainments that we use and have.

8. Debt

I realized that debt is a very sensitive topic. Some people are not comfortable talking about debts. When my husband and I just started, sometimes, acquiring debt seems inevitable. When something comes up, and there's no budget for it, the tendency, we turned to debt to cover those expenses.

As our marriage grow and we got know each other more and had very valuable life experiences together, my husband and I learned how to manage our finances eventually. We worked as a team to overcome shortcomings and discovered financial strategies that made us better in navigating the complex world of couple's finance.

What I can share as our take aways on these valuable experiences are:

- If you want to use/carry credit cards, pay the full balance every month. You don't want the lender/credit card companies to sucked your hard-earned money by paying monthly interest which the credit card companies are the only one getting rich from YOU.

- If you can't pay you full balance every month, balance transfer your debt to another credit card company that offers 0% interest for the first 15 months or so. This way, you don't have to pay interest on your credit. Make sure you'll pay your full credit balance within the months that you have 0% interest on your credit.

- If you still can't pay your debt, make sure to make a plan with a certain time goal on when to pay your debt in full. And while doing this, don't acquire new debts.

- Having zero debt is liberating. You'll feel FREE.

9. Miscellaneous

For this category, this is anything that does not belong to any previous category. For any expenses that are expected like car repairs, I usually have sinking funds that I start at the beginning of the year which is January. A $10 per pay check which can be auto transfer into a high yield savings is a big help.

By the way, I have mentioned on the "Income & Savings" that we save using a High Yield Savings Account. If you wonder what bank offers a "High Yield Savings" account, I would recommend: Ally Bank. https://www.ally.com/bank/online-savings-account/?CP=ppc-bing-bkws-bank-ally-bank-exact-desktop&source=Paid-Search-Web&d=c&ad=81157782257378&gclid=ee98700ae84d10b76b3d11903b15fb80&gclsrc=3p.ds&msclkid=ee98700ae84d10b76b3d11903b15fb80

Ally Bank is one of the banks that have high interest savings account. Due to the pandemic, their interest savings account has been lowered but as every other banks too. They are still one of the banks that has high interest with their savings account. They have interest too on their checking account. Most banks don't even give you interest with your checking account. Do check on Ally Bank.

Another is T-Mobile Money: High Interest, No-Fee Online Checking Account | T-Mobile MONEY

But in order to get the 4% interest on their Checking account, you need to have 10 qualifying purchases per month. And the 4% is only for $3000 or less amount in your checking. When the amount is over $3000, then their checking account interest lowers down to 1% which is still high compare to other banks.

I would say this is still a great deal. I'll just make sure my money in my checking account does not exceed $3000 and we use the debit card 10x per month. My husband is very diligent when it comes to this. He marks and takes note of the number of times we use the card. Making sure it reaches 10x and nothing more.

10. Monthly Summary

When all the income and expenses are in, I usually do the Monthly Summary at every end of the month or at times within the last week of each month. Having a "difference" on all or even some of the categories is a cause of celebration for me. It means I did well on my budgeting for that month. But when/if I don't have any difference at all, just getting even is good enough. Having a "difference" means I could add more to our savings. But if my monthly budget summary has no difference on it, I don't sweat too much, I just do better the next month and next months after that. It is a learning process every single time.

That's it. That's my Monthly Financial Plan. I hope you learn something from this and maybe we could trade some financial strategies that you have that could be helpful to make my Monthly Financial Plan better. Please comment or send me a message any time.

Facebook Account: (3) Cherubim Costa | Facebook

Email Account: renecherubs@yahoo.com

Twitter Account: cherubim ibarrientos (@renecherubs2013) / Twitter

Instagram Account: Cherubim C. Ibarrientos

Sunday, October 31, 2021

Free Snack Pack from Love Acorn

Free Snack Pack from Love Acorn Still Working Guys.

Everything is FREE including FREE SHIPPING. Use code: FMF9 @ checkout for FREE SHIPPING. Hurry before its over.

FREE SNACK PACK from Love Corn

Translate

Popular Posts

-

We went to safeway today. Got my 4 NAKED JUICE 15.2 oz. The cashier and I were surprised. I got a $.027 cents overage after entering my card...

-

I've been doing monthly financial plan since I got married. This has made my/our lives so much easier and less stressful when it ...

-

Cut the Cord-Check this Best Cable Alternatives Came across this amazing site. I am pretty sure we all wanted to save money on TV Cables a...

-

Published from Original Post on January 27, 2013 Original Post Link Here New Link #1: Buy 2 Large Digiorno Pizzas, Get ANY One...

-

Published from Original Post on February 5, 2013 Original Post Link Here **SCENARIO** Buy TWO Nature Made Full Strength Minis Omega-...

-

Features: Includes samples of 6 essential baby care brands for your newborn, plus savings and information Click Here . Then ...

-

Received my first paypal cash from opinion outpost. They'll give $10 for 100 points. Just wanted to share this info. for thos...

-

Published from Original Post on January 17, 2013 Original Post Link Here Starting the week of 2/3, Rite Aid will have Keri Lotion ...

-

Published from Original Post on January 4, 2013 Original Link Here Hurry and print out this SAVE $1.00 on any ONE (1) Suave® Hand ...

-

Published from Original Post on January 17, 2013 Original Post Link Here Hurry and print this high-value $2 off One Neutrogena...